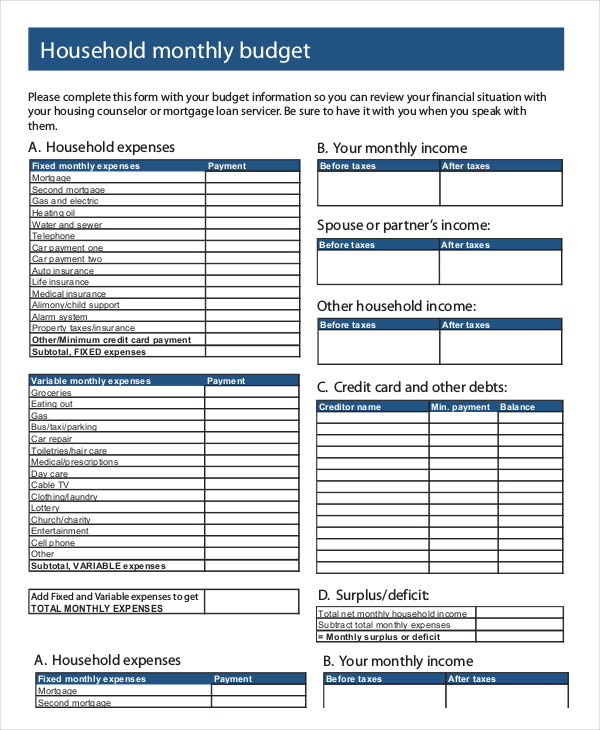

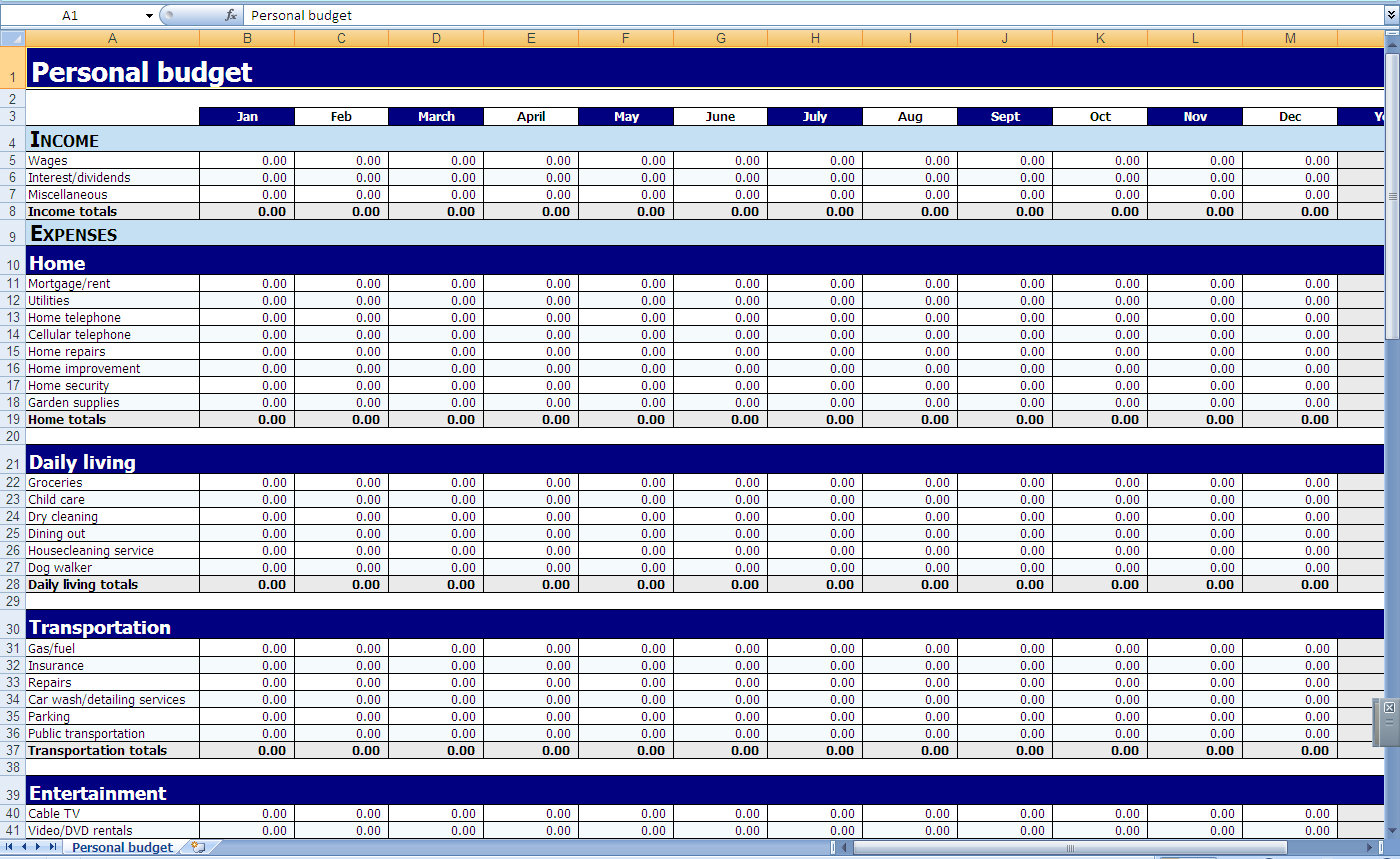

Average monthly debt paymentsĬonsumers spend - on average - $1,233 a month paying down debt. Gasoline, other fuels and motor oil: $179īut those budget categories don’t tell the whole story for all Americans when it comes to average monthly expenses and how they fit into an annual budget.Vehicle purchases (purchase price minus trade-in value): $301.Utilities, fuels and public services: $334.Cash contributions (including alimony, child support and donations to religious, political and other organizations): $114.Here’s how those earnings were used to pay off the following monthly expenses: households within that income level spend an average of $53,104 on annual expenditures. According to the Bureau of Labor Statistics, U.S. Keep in mind that your expenses can vary depending on where you live in the U.S.īudget wisely for average monthly expenses Average household budget Student Loan Hero researchers analyzed data from several sources to get an idea of how the average American household budget shapes up. You need to cover basic needs such as food, shelter and clothing, but your average monthly expenses could also include debt payments, retirement contributions, child care, private school and more.

#Budget monthly expenses how to

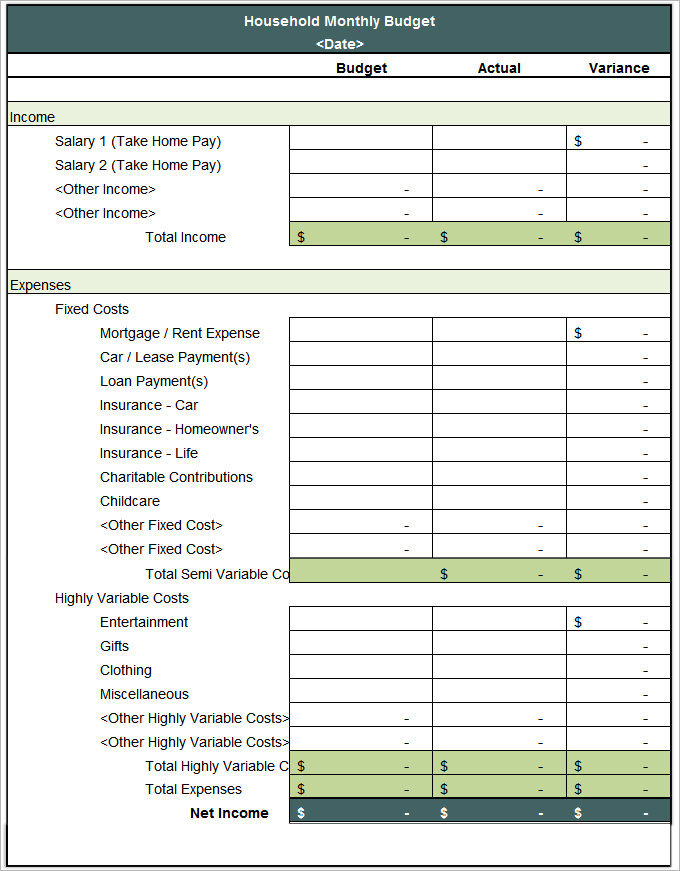

Or you might be able to save more if you get a pay rise or you pay off some debt.Learning how to create a budget for your household can be complicated. Your budget needs to work for you and your lifestyle so it's important to adjust your budget as things change.įor example, if your expenses start to increase you may need to reduce your spending, or change your savings goal. Even a small amount set aside regularly will make a difference. Having some savings can create a safety net for unexpected expenses. Once you know how much money you have for 'wants', you can work out how much of it you'd like to save. If you have a savings goal you can use your budget to work towards it. This will help you to see where it goes and keep within your spending limit. Make a plan for what you want to do with your spending money. Your spending money is for 'wants', such as entertainment, eating out and hobbies. The money you have left after expenses is your spending and saving money. If you tracked your spending, use your list of transactions. Include what the expense is for, how much and when you pay it. To make sure you've recorded all your expenses, look at your bills or bank statements. family costs, like baby products, child care, school fees and sporting activities.

#Budget monthly expenses registration

This money could be from your wages, pension, government benefit or payment, or income from investments.

If you don't have a regular income, work out an average amount. Record how much money is coming in and when. For example, if you get paid weekly, set up a weekly budget. Use how often you get paid as the timeframe for your budget. You can put aside money for bills and expenses and set up a plan to reach your financial goals.įollow these steps to get started.

Having a budget helps you see where your money is going.

0 kommentar(er)

0 kommentar(er)